MRED Blog

REinventing MLS

MRED’s response to Zillow Attack on PLN

“Portals broadly want to protect their access to listings.”

Zillow created a strategy document in December of 2024. This “highly confidential” 30-page document recently made public from Zillow’s legal battle with Compass details how Zillow could mitigate “the erosion of traffic and eventually revenue”, which resulted from MLSs using private listing networks.

Zillow decided its strategy could be “more aggressive with hardline tactics to keep ALL listings in IDX, on Zillow”. One of the “hardline tactics” was to “Mobilize local and national organizations to publicly warn brokers and agents on the fair housing risks of reduced access to real estate information.”

Given this context, it is not surprising that Zillow conducted a one-day study in the Chicagoland market that attacks MRED’s Private Listing Network (PLN).

MRED takes Fair Housing very seriously, with rules and processes in place to scan all private and active listings for violations. We also believe that any bad actors deserve all consequences, professionally and legally, that come to them. Notably, Zillow’s strategy document does not explicitly mention protecting Fair Housing principles, outside of using as a tactic in its “Model Market Playbook”.

MRED launched the PLN in 2016 to make all properties available to all agents and brokerages across the market. We want to prevent the use of shadow networks off the MLS that could lead to discrimination and exclusion. As a contrast, Zillow wants “to punish the agent for choosing to put their listings on alternate networks” like MRED’s PLN. We are proud of the steps we have taken to support all business models in our MLS to work together.

“Every real estate professional has access to MRED’s private listing network,” said Cecelia Marlow (President of Dearborn Realtists, a Chicago association for Black real estate professionals that dates to 1941, via Crain’s, November 21st 2025).

MRED relies heavily on data. We reached out to Zillow for the specifics behind its methodology and have not received it yet. We feel it is important to note that:

- There are three times as many active listings in majority white zip codes as non-white zip codes.

- iBuyers and institutional investing heavily target non-white majority neighborhoods, which once purchased become rentals.

- Zillow’s study does not seem to account for other factors, such as rentals and off MLS transactions (including their own For Sale By Owner properties).

In an MIT study about iBuying, it was noted that “Seller vulnerability could play a role, as homeowners in these communities may be more likely to accept below-market offers due to financial strain, lack of savings for repairs, or the need for immediate liquidity.”

In our opinion, Zillow’s approach in Illinois and its recent criticism of MRED’s PLN appears to be driven less by data and more by a cynical strategic objective: securing control over listing distribution to protect its revenue. Their criticism of MRED’s PLN does not seem to be about protecting consumers or advancing fair housing. It appears to be part of a broader strategy to secure complete control of listing distribution and undermine the cooperative foundation of MRED.

MRED was built to safeguard open access, prevent discrimination, and ensure that every brokerage, large and small, can compete on equal footing. Our PLN was created to prevent exclusionary shadow markets, not enable them. Our ongoing monitoring, compliance systems, and rules reflect our commitment.

Fraud Alert: Don’t Click the Wrong Zoom Link

Scammers are targeting real estate professionals through fake Zoom invites. They pose as out-of-town buyers, request meetings, and send links that look legitimate—but one click can expose your login credentials and compromise your business.

These fake meeting links can install malware, steal data, and grant unauthorized access to your professional accounts.

MRED is committed to keeping subscribers informed and safeguarding their interests. Our goal is to ensure you always have the tools, information, and awareness to recognize digital threats before they impact your business.

You can stop scammers before they start. Here’s how:

- Verify the sender’s email. Only open invites from verified business addresses.

- Hover before you click. Legitimate Zoom links come from zoom.us or zoom.com.

- Avoid vague or urgent messages. Scammers rely on pressure and fear.

- Use your Zoom app directly. Enter the meeting ID instead of clicking links in emails.

- Delete suspicious downloads. If an email tells you to install “new Zoom software,” it’s a red flag.

By staying alert and informed, you protect more than just your login credentials—you’re safeguarding your business, your clients’ trust, and your data security.

Want your commercial listings seen by serious buyers?

Are your commercial listings getting the attention they deserve? We want to help!

That’s why MRED has teamed up with Crexi, a leading commercial real estate platform with millions of active users, to give your listings even greater reach.

With a few clicks, you can syndicate directly from connectMLS to Crexi—no duplicate work, no extra fees.

Here’s what you’ll get:

- Access to a nationwide audience of commercial prospects

- Total control to syndicate only the listings you want

- Performance tracking and lead engagement tools

- Seamless workflow—list in connectMLS, syndicate via Crexi

Not sure if your brokerage is taking advantage of this new service? Contact the MRED Help Desk at help.desk@mredllc.com.

connectMLS Client Portal updates: you asked; MRED listened!

The updated connectMLS Client Portal makes it easier than ever to chat with clients about listings all in one place! This social media-style setup helps you keep track of your client’s interest, preferences, and questions about listings to avoid confusion and searching through old texts and emails. Your clients can also search for listings in the MLS, including eligible Private listings.

Clients will be able to search for listings in their connectMLS portal.

- Your clients will be able to browse listings and save searches in their connectMLS client portal.

MRED has streamlined communication features.

- You’ll be able to see your clients’ saved searches and activity right on your MLS home page.

User and mobile-friendly client portal.

- Presentation is everything! The connectMLS client portal is getting a facelift to make it more modern in appearance and easier to navigate.

Here’s how to opt-in to the new client portal:

- Go to your initials/photo at the top-right of connectMLS

- Click “Client portal defaults” under “My defaults”

- Click “Portal Type (“Modern” vs. “Modern 2.0”)

- Select “Modern 2.0”

Sign up for a session on the client portal. For a recorded webinar, click here.

Zenlist and its top-rated mobile app are LIVE for MRED subscribers!

You asked for a better mobile app from the MLS, and MRED is delivering a collaboration with Zenlist, providing you with another choice in MLS platforms! This is part of our commitment to enabling a customized MLS experience that works best for you.

Some of the many benefits of Zenlist include:

- Top-rated iPhone and Android apps.

- An easy-to-use navigation design.

- Robust search capabilities.

Zenlist is now available as an alternative way to search the MLS in addition to connectMLS. We’re also working on an integration with Paragon Connect.

Click here to Claim your Zenlist Starter account. For a limited time, you’ll be able to access both MLS options and choose which works best for you as your future day-to-day system. Be on the lookout for more updates from Zenlist, including the ability to search Private listings, add or edit listings, and much more.

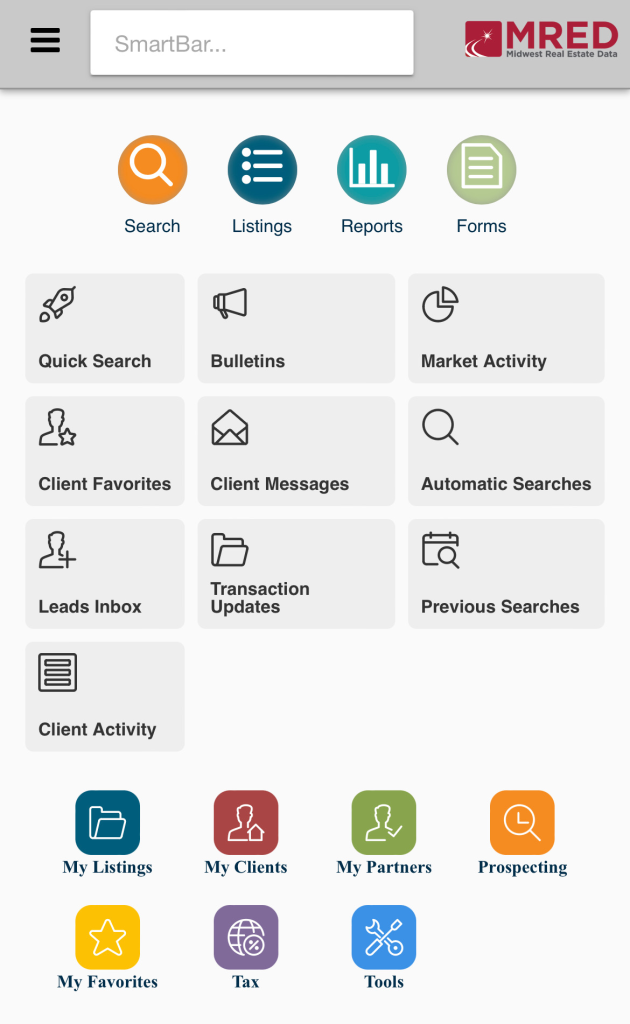

The new connectMLS app is available now!

It’s here!

We have some exciting connectMLS news! One of our top subscriber requests has been for the MLS to have its own mobile app. We’re thrilled to let you know that this is finally a reality!

What can you expect from the new connectMLS mobile app? It’s designed to make your life easier and more efficient. With the app, you can log in just once and stay logged in, ensuring quick and easy access to the vital information that powers your real estate business. It also offers enhanced on-the-go functionality for forms and market reports, making your work on the move a breeze.

Have question or need assistance? Reach out to our Help Desk at help.desk@mredllc.com or 630-955-2755. We’d also love to hear any feedback you have about the app and how it works for you!